Walmart e-commerce to increase grocery category purchases Fer House

According to consulting firm Insider Intelligence data released earlier this month. Walmart, the largest U.S. retailer is expanding its grocery category e-commerce segment, the market leader and is on track to by the end of 2024 controlling a market share of 26.9 percent.

well ahead of its closest competitor, Amazon.

Amazon's e-commerce share in the grocery category will fall to 18.5 percent over the next year, the despite its continued sales growth.

Insider Intelligence says Wal-Mart Stores Inc. is gaining market share at an increasingly rapid pace so much so that "Amazon is having a hard time reversing the trend." The latest figures show that Walmart is using its size to consolidate its position in the U.S. grocery e-commerce market. scale to solidify its dominance in the U.S. grocery e-commerce market. dominance in the U.S. grocery e-commerce market.

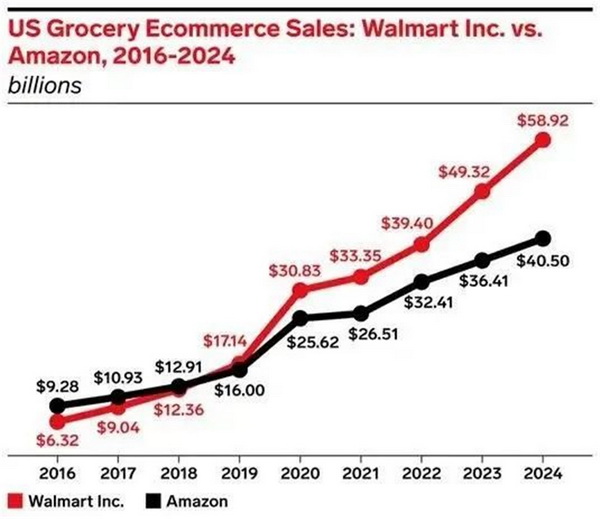

Insider Intelligence expects Walmart's 2024 online sales to reach $58.92 billion, an increase of 19.5 percent up from $49.32 billion this year, an increase of 19.5%. In contrast Amazon, on the other hand, predicts that over the same period online sales of groceries will grow 10 percent in the same period, up from $36.41 billion in 2023 to $40.5 billion next year. in 2023 to $40.5 billion next year.

Amazon and Walmart are now in the grocery e-commerce business The widening gap is a far cry from where it was just a few years ago. Back in 2016, the Amazon had taken control of 24% of the grocery e-commerce market compared to Walmart's 16.4% share. But Walmart managed to overtake in 2019 and has maintained its lead ever since.

The chart below shows how Walmart in the coming years how it will widen its gap with Amazon in grocery e-commerce sales.

According to Insider Intelligence. Walmart data collected includes delivery and pickup and sales from third-party delivery services. Amazon's data includes Amazon Fresh and delivery and pickups from its Whole Foods supermarkets, the as well as direct and indirect sales on Amazon's platforms.

Insider Intelligence analyzes that Walmart's dominance in grocery e-commerce due in part to the proximity of its stores to the vast majority of the U.S. population. This factor gives Walmart an advantage in providing shoppers with the number of locations offering pickup services to shoppers. As inflation drives shoppers to seek lower prices, Walmart benefits. Walmart has benefited greatly.

Walmart's global revenue rose to $160.8 billion in the third quarter, a That's a 5.2 percent increase over last year. Walmart's U.S. division's e-commerce grew 24 percent strong performance in pickup and home delivery services. Sam's Club's e-commerce grew 16% and Sam's Club e-commerce grew 16 percent and 15 percent globally.

Of this, same-store sales in the U.S. increased 4.9 percent and net sales increased 4.4% to $109.4 billion. However, operating income declined 2.2% to $5.0 billion. Due to higher-than-expected expenses, the resulted in lower-than-expected growth.

Walmart continued to invest in the quarter in its e-commerce infrastructure. It opened the next generation of its ongoing logistics facility, the third of which is being built to speed up distribution.

Wal-Mart raised its full-year consolidated net sales guidance from 4% to 4.5% to 5% to 5.5%. For consolidated operating profit Walmart maintained its growth guidance of 7% to 7.5%.

Wal-Mart's chief financial officer John David Rainey said during an investor conference that "As Walmart focuses on improving e-commerce margins by leveraging our own broad store distribution, we are making good progress in reducing the last mile of e-commerce distribution costs and making good progress."

"Looking ahead. We expect the relationship between profit and sales growth will favor maintaining profitability in the fourth quarter and Full-year results will be consistent with our goal of operating income growing faster than sales."

In an effort to catch up with Walmart Amazon has also been taking steps to improve its grocery e-commerce business. In October, the company reduced the shopper the minimum amount of free shipping when ordering groceries online. And earlier this month, it announced that it had begun offering grocery delivery and free shipping in certain areas to non-Prime non-Prime member shoppers in certain areas.

We have also worked with Walmart. The main products we export are kitchen organizer series (Bathroom Laundry Storage Baskets, Modern Napkin Holder, Kitchen Organizers With Storage Drawer, Trolley Service Shelving Cart); tabletop series,;home organizer series and bathroom series products.

In order to cope with the ever-changing foreign trade situation, our company constantly develops new customers and new products. With a positive and innovative attitude, we lead the industry in innovation.